The landscape of weight-loss treatment in America stands at a pivotal crossroads. As the Trump administration signals potential changes to GLP-1 medication coverage policies, millions of Americans struggling with obesity and weight management are watching closely. This policy shift could fundamentally alter access to groundbreaking medications like Ozempic, Wegovy, and Mounjaro.

What Are GLP-1 Medications and Why Do They Matter?

GLP-1 (glucagon-like peptide-1) receptor agonists represent a revolutionary class of medications originally developed for type 2 diabetes management. These drugs work by mimicking natural hormones that regulate blood sugar and appetite, leading to significant weight loss in many patients.

Popular GLP-1 medications include:

- Ozempic (semaglutide) – FDA-approved for diabetes

- Wegovy (semaglutide) – FDA-approved for weight loss

- Mounjaro (tirzepatide) – Dual GLP-1/GIP receptor agonist

- Zepbound (tirzepatide) – Approved for obesity treatment

The clinical results have been remarkable, with patients experiencing average weight loss of 15-20% of their body weight in clinical trials.

The Current Insurance Coverage Landscape

Today, GLP-1 insurance coverage remains frustratingly inconsistent across America. Many health insurance plans cover these medications for diabetes management but exclude them when prescribed specifically for weight loss, despite FDA approval for obesity treatment.

Current Coverage Barriers:

- High out-of-pocket costs ranging from $900 to $1,500 monthly

- Strict prior authorization requirements

- Limited Medicare and Medicaid coverage

- Employer insurance plans often exclude weight-loss medications

- Income-based access disparities

This coverage gap has created a two-tiered system where affluent patients can access life-changing treatments while others cannot afford them.

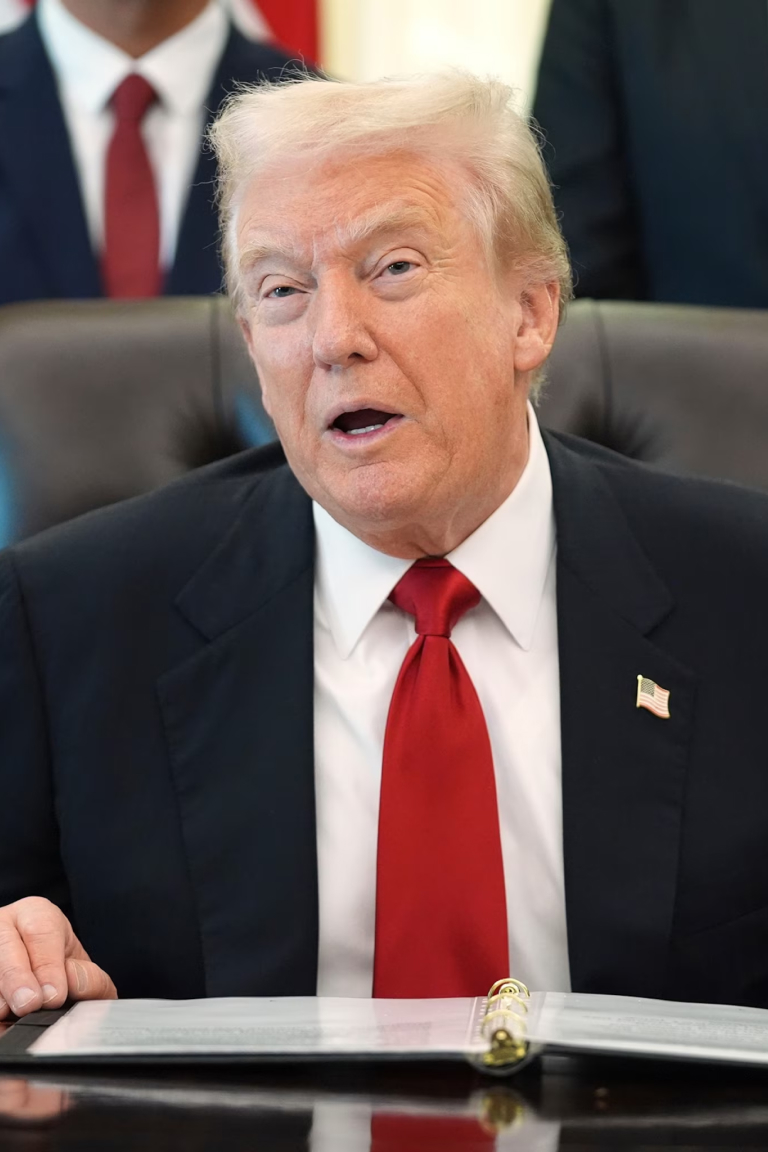

Trump’s Proposed Coverage Expansion: What’s on the Table?

The Trump administration’s interest in expanding GLP-1 insurance coverage stems from several key factors. Reports suggest the policy push focuses on recognizing obesity as a serious medical condition requiring pharmaceutical intervention, similar to other chronic diseases.

Potential Policy Changes Include:

- Medicare Coverage Expansion: Removing restrictions that currently prevent Medicare from covering weight-loss medications

- Medicaid Mandates: Requiring state Medicaid programs to include GLP-1 medications in their formularies

- Private Insurance Requirements: Establishing minimum coverage standards for employer-sponsored and marketplace plans

- Price Negotiation Power: Leveraging government purchasing power to reduce medication costs

The administration’s rationale centers on long-term healthcare cost savings, as obesity-related conditions cost the U.S. healthcare system hundreds of billions annually.

Market Impact: Winners and Losers

Pharmaceutical Companies

Drug manufacturers like Novo Nordisk and Eli Lilly stand to benefit enormously from expanded coverage mandates. However, they may face pressure to reduce prices in exchange for guaranteed market access.

Insurance Companies

Health insurers express concerns about immediate cost increases, though some analyses suggest long-term savings from reduced obesity-related complications like heart disease, stroke, and joint problems.

Healthcare Providers

Doctors and weight management clinics could see increased patient volume, but administrative burden from prior authorizations and coverage verification may also rise.

Patients

Expanded coverage would represent life-changing access for millions, though questions remain about sustainability and long-term medication adherence support.

The Economic Argument: Cost vs. Benefit

Supporters of expanded GLP-1 insurance coverage point to compelling economic data. Obesity costs the American healthcare system an estimated $173 billion annually in direct medical expenses. Associated conditions include:

- Type 2 diabetes

- Cardiovascular disease

- Sleep apnea

- Joint problems and osteoarthritis

- Certain cancers

- Mental health challenges

Studies suggest that widespread GLP-1 medication access could reduce these downstream costs substantially, potentially offsetting the medication expenses within 5-10 years.

Critics argue that not all patients maintain weight loss after discontinuing medications, questioning whether insurance should fund potentially lifelong pharmaceutical therapy.

Political and Public Health Considerations

The push for GLP-1 coverage expansion transcends typical partisan healthcare debates. Both conservative and progressive voices recognize obesity as a legitimate public health crisis affecting over 40% of American adults.

Key Political Factors:

- Bipartisan obesity concern: Recognition of obesity as a national health emergency

- Economic productivity: Healthy workers contribute more to the economy

- Healthcare system strain: Reducing long-term treatment costs for obesity-related conditions

- Pharmaceutical industry influence: Lobbying efforts and campaign contributions

- Patient advocacy: Growing grassroots movements demanding treatment access

What This Means for Average Americans

For the estimated 100 million American adults with obesity, expanded GLP-1 insurance coverage could represent unprecedented access to effective treatment. However, several practical considerations remain:

Implementation Challenges:

- Supply chain concerns: Can manufacturers produce enough medication to meet demand?

- Healthcare infrastructure: Are there sufficient providers to prescribe and monitor treatment?

- Patient education: Do people understand these medications require lifestyle changes?

- Long-term adherence: What happens when patients stop taking medication?

Global Context: How America Compares

Other developed nations have approached GLP-1 coverage differently. The United Kingdom’s National Health Service covers certain GLP-1 medications under strict criteria. Canada offers provincial coverage with varying restrictions. Australia includes some formulations on its Pharmaceutical Benefits Scheme.

America’s fragmented insurance system makes nationwide coverage expansion particularly complex compared to single-payer healthcare systems abroad.

Industry Response and Market Preparation

Pharmaceutical companies are already scaling up production in anticipation of policy changes. Novo Nordisk announced major manufacturing facility investments, while Eli Lilly expanded its production capacity significantly.

Generic and biosimilar manufacturers are also positioning themselves to enter the market as patents expire, which could dramatically reduce costs and improve access regardless of insurance coverage mandates.

Expert Opinions: What Healthcare Professionals Say

Endocrinologists and obesity medicine specialists generally support expanded coverage but emphasize the importance of comprehensive treatment programs. Medication alone rarely produces optimal outcomes without dietary counseling, exercise programs, and behavioral health support.

The American Medical Association recognizes obesity as a disease, supporting insurance coverage for evidence-based treatments including GLP-1 medications when medically appropriate.

Timeline and Implementation: What Comes Next?

While exact timelines remain uncertain, policy implementation typically requires:

- Regulatory proposal: Administration drafts specific coverage mandates

- Public comment period: Stakeholders provide feedback (60-90 days)

- Final rule publication: Policy details are finalized

- Implementation period: Insurance companies adjust coverage (6-12 months)

- Enforcement begins: New coverage requirements take effect

Realistically, even with aggressive policy action, widespread coverage changes would likely take 12-24 months to fully implement.

How to Prepare for Potential Coverage Changes

For Patients:

- Document your medical history and obesity-related health conditions

- Discuss GLP-1 medications with your healthcare provider

- Understand your current insurance plan’s coverage policies

- Monitor policy announcements from your insurer

- Consider medical weight-loss programs that may improve coverage eligibility

For Healthcare Providers:

- Stay informed about evolving coverage policies

- Develop protocols for GLP-1 prescription and monitoring

- Build relationships with specialty pharmacies

- Prepare patient education materials

- Consider staffing needs for increased patient volume

The Bigger Picture: Transforming Obesity Treatment

Beyond insurance coverage, the GLP-1 discussion reflects a fundamental shift in how America views obesity. Rather than a personal failing requiring willpower alone, there’s growing recognition of obesity as a complex medical condition influenced by genetics, environment, metabolism, and psychology.

This policy push represents potential validation that obesity deserves the same insurance coverage and medical attention as other chronic diseases.

Potential Downsides and Concerns

Not everyone views expanded GLP-1 coverage positively. Critics raise valid concerns:

- Medicalization of weight: Does covering weight-loss drugs discourage lifestyle interventions?

- Long-term dependency: Will patients need lifelong medication?

- Side effects: Not everyone tolerates GLP-1 medications well

- Healthcare costs: Will short-term expenses strain insurance systems?

- Equity questions: Will coverage favor certain demographics over others?

The Role of Lifestyle Medicine

Healthcare experts emphasize that GLP-1 medications work best alongside comprehensive lifestyle interventions. Nutrition counseling, exercise programs, stress management, and sleep optimization remain crucial for sustainable weight management.

Ideally, insurance coverage expansion would include not just medications but also:

- Registered dietitian consultations

- Exercise physiology services

- Behavioral health support

- Long-term maintenance programs

Conclusion: A Watershed Moment for Weight Management

Trump’s push for expanded GLP-1 insurance coverage could mark a defining moment in American healthcare policy. Whether these changes ultimately materialize depends on regulatory processes, political will, industry cooperation, and public pressure.

For millions of Americans struggling with obesity, the stakes couldn’t be higher. Expanded coverage could democratize access to treatments that were previously available only to the wealthy, potentially improving public health outcomes while reducing long-term healthcare costs.

As this policy landscape evolves, staying informed and engaged will be crucial for patients, providers, and policymakers alike. The conversation around GLP-1 insurance coverage represents more than pharmaceutical policy—it reflects our society’s evolving understanding of obesity, health, and healthcare access.

The coming months will reveal whether this coverage shake-up becomes reality or remains aspiration. Either way, the discussion has already shifted national dialogue about obesity treatment and insurance responsibility in meaningful ways.

FAQ: GLP-1 Insurance Coverage

Q: When will insurance companies be required to cover GLP-1 medications? A: No mandate currently exists, though proposed policies could take effect within 12-24 months if implemented.

Q: How much do GLP-1 medications cost without insurance? A: List prices range from $900-$1,500 monthly, though manufacturer coupons and patient assistance programs may reduce costs.

Q: Will Medicare cover weight-loss medications? A: Current law prohibits Medicare from covering weight-loss drugs, but proposed policy changes could eliminate this restriction.

Q: Are GLP-1 medications safe for long-term use? A: Clinical trials show favorable safety profiles, though patients should discuss individual risks with healthcare providers.

Q: What happens if I stop taking GLP-1 medications? A: Many patients regain weight after discontinuation, highlighting the importance of lifestyle modifications alongside medication.